Article published on TerrainAg.com. Author John Newton is the Executive Head of Terrain. Guiding the team’s endeavors, he has more than two decades of experience using data to address agriculture’s challenges.

With Congress authorizing another one-year extension of the 2018 farm bill through September 30, 2025 (in addition to more than $30 billion in ad hoc assistance to agricultural producers experiencing natural and economic disasters), crop farmers across the country now know what risk management tools are available to them for the new crop year.

For some crops such as corn, soybeans and wheat, coverage levels will increase to levels at or near all-time highs.

In addition to crop insurance, crop farmers with eligible base acres may enroll in Agriculture Risk Coverage (ARC) or Price Loss Coverage (PLC) on a commodity-by-commodity basis (see ARC and PLC Program Explainer).

For some crops such as corn, soybeans and wheat, coverage levels will increase to levels at or near all-time highs. For these crops, the additional support may help offset expected tighter crop margins in 2025 regardless of economic assistance provided by the American Relief Act. For other crops such as seed cotton, rice or peanuts, their ARC and PLC guarantees are at or slightly above the minimum level of support provided through farm bill programs.

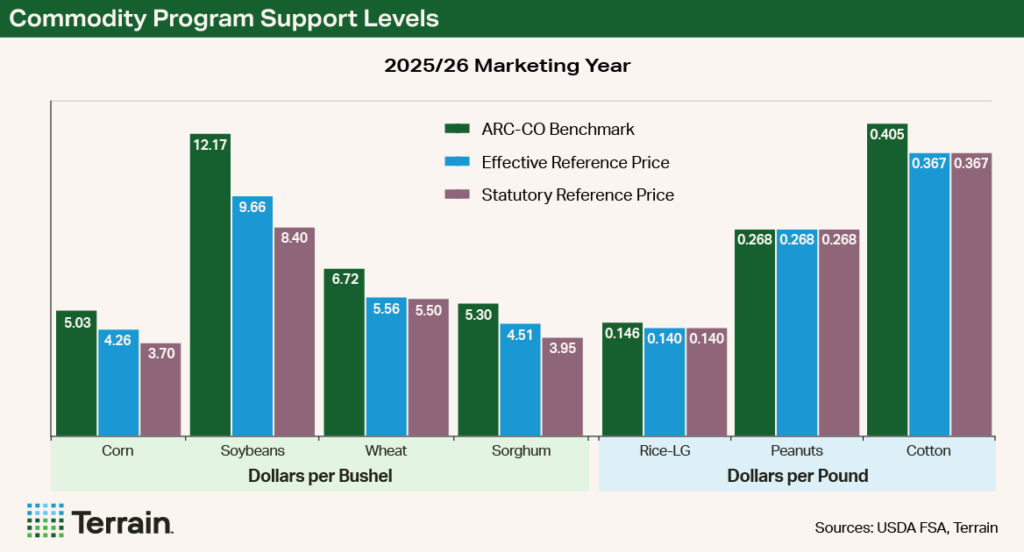

Comparing Support Levels

For both ARC and PLC, and for the 2025/26 crop year, the prices used to determine the revenue guarantee and the effective reference price are based on data from the 2019 to 2023 crop years. With marketing year average prices for 2023 finalized in mid- to late 2024, and with the farm bill now extended for another year, ARC-County Option (ARC-CO) and PLC support levels for 2025 are now known.

For the 2025/26 crop year, the ARC-CO benchmark prices for corn and soybeans are the highest level of support since the 2015/16 marketing year. Wheat is at the highest level of support since ARC-CO was introduced in the 2014 farm bill. Here is a detailed price list:

- Corn ARC-CO benchmark price is $5.03/bu., up 18 cents/bu. from the previous year

- Corn PLC effective reference price is at the maximum of $4.26/bu.

- Soybean ARC-CO benchmark price is $12.17/bu., up $1.05/bu. from the previous year

- Soybean PLC effective reference price is at the maximum of $9.66/bu.

- Wheat ARC-CO benchmark price is $6.72/bu., up 51 cents/bu. from the previous year

- Wheat PLC effective reference price is $5.56/bu., slightly above the PLC statutory reference price of $5.50/bu.

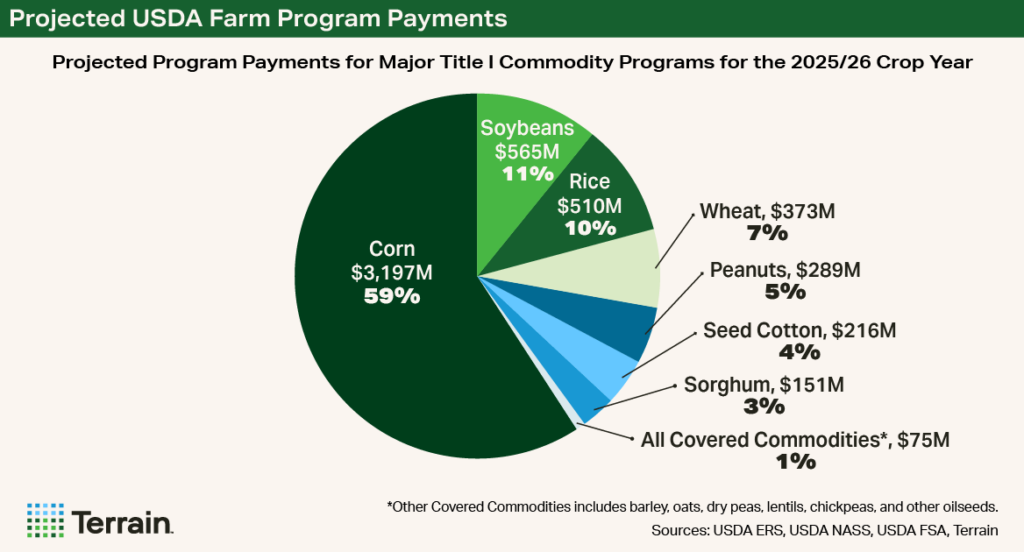

Projected Program Payments

For major crops such as corn, soybeans and wheat, the ARC benchmark prices are at or near their all-time highs. However, these higher levels of support follow sharp increases in crop input costs, rapidly declining crop prices, and margins that have been at or below breakeven for several years in a row. The tight margin environment has contributed to a sharp decline in overall farm profitability since 2022.

Given current USDA price expectations, for the 2025/26 crop year both ARC-CO and PLC would deliver support to corn and soybean farmers with eligible base acres. For wheat base acres, the higher level of price support under ARC-CO may result in program payments should a county’s yields fall below the Olympic moving average given current expectations for higher prices.

According to the CBO, total program payments for the 2025/26 crop year are projected at $5.4 billion.

For farmers with sorghum base acres, program payments are likely, as the support from both ARC and PLC is well above the USDA’s projected price of $3.80/bu. for 2025. For seed cotton, the ARC guarantee is approximately 10% above the effective reference price and may yield program payments if a county’s yields are low. For crops like rice or peanuts, their levels of income support are not materially different than those authorized under the 2014 farm bill over a decade ago.

While program payments are far from certain, the Congressional Budget Office’s June 2024 Baseline Projections for USDA Mandatory Farm Programs provided an early look at potential farm program payments for the 2025/26 crop year. According to the CBO, total program payments for the 2025/26 crop year are projected at $5.4 billion, with approximately $3.6 billion in PLC payments and $1.7 billion in ARC-CO payments. (Note: This will change as enrollment decisions become known.)

- Corn is projected to receive $3.2 billion in program payments, or approximately $39 per base acre

- Soybeans are projected to receive $565 million in program payments, or approximately $12 per base acre

- Wheat is projected to receive $373 million in program payments, with an average payment of $7 per base acre

While lower prices and revenue are expected to result in more than $5 billion in commodity program payments from ARC and PLC, most of these crops will be planted in spring 2025, and the program payments will not be made until fall 2026 — an 18-month difference from when a majority of costs are incurred to plant a crop and when federal support is provided.

Farmers with eligible base acres will have an opportunity to enroll those acres in ARC or PLC on a commodity-by-commodity basis this spring.

Program Election Is Part of Risk Management Plan

Farmers with eligible base acres will have an opportunity to enroll those acres in ARC or PLC on a commodity-by-commodity basis this spring. Which programs farmers choose for each covered commodity will depend on their risk preferences (that is, price- or revenue-based coverage) and the expected program payment.

Due diligence is required, as participation in Title I commodity support programs may be affected by crop insurance purchases (for example, use of Supplemental Coverage Option). Working with a Farm Credit crop insurance agent can help farmers assess the risk environment and craft a risk management strategy across crop insurance and commodity support programs that works best for their crop operation.

ARC and PLC Program Explainer

Agriculture Risk Coverage-County Option

ARC-CO is an area-based revenue and income support program that provides payments to farmers when the actual county-level revenue (the county average crop yield multiplied by the marketing year average price) falls below 86% of the benchmark revenue (that is, the revenue guarantee).

The benchmark revenue, or revenue guarantee, is the product of the five-year Olympic moving average price and the county average trend-adjusted yield. The five-year Olympic averages remove the highest and lowest values and then average the remaining three values. To address low commodity prices, or large yield declines at the county level, the five-year Olympic average uses “plug” prices and yields — equal to the effective reference price and 80% of a county’s transitional yield, respectively. The use of plug values reduces variability and smooths the revenue guarantees available under ARC-CO.

Program payments under ARC-CO are capped at 10% of the benchmark revenue, and program payments are made on 85% of the farm’s base acres of the covered commodity.

Price Loss Coverage

While ARC-CO support is based on the county-level crop revenue (national average price multiplied by county average yield), PLC is based solely on price. PLC delivers a program payment when the national marketing year average price falls below the effective reference price (that is, the price support level).

The 2018 farm bill created the effective reference price to allow statutory reference prices, and the corresponding support level, to increase following high commodity price environments like the one grain and oilseed farmers recently experienced. The effective reference price is equal to the maximum of 85% of the five-year Olympic moving average price (without plug prices) and the effective reference price and is capped at 115% of the statutory reference price.

For example, corn has a statutory reference price of $3.70/bu. and a maximum effective reference price of $4.26/bu. (115% x $3.70).

When program payments are triggered under PLC, the total payment to the farmer is based on 85% of the farmer’s base acres and the farmer’s farm-level PLC yield. PLC payment rates are capped at the difference between the effective reference price and the USDA’s marketing assistance loan rate.

Terrain™ content is an exclusive offering of Farm Credit Services of America, Frontier Farm Credit and American AgCredit.

While the information contained in this site is accurate to the best of our knowledge, it is presented “as is,” with no guarantee of completeness, accuracy, or timeliness, and without warranty of any kind, express or implied. None of the contents on this site should be considered to constitute investment, legal, accounting, tax, or other advice of any kind. In no event will Terrain or its affiliated Associations and their respective agents and employees be liable to you or anyone else for any decision made or action taken in reliance on the information in this site.