Agricultural outlook for Q1 2026 from Terrain™, our service for agricultural insights. Author Ben Laine is Terrain’s senior dairy analyst. This article originally appeared on TerrainAg.com.

Report Snapshot

Situation

With global milk supply cresting, demand will struggle to stay afloat. The result will be low milk prices in the near term. However, strong beef-on-dairy revenues should soften the blow.

Finding

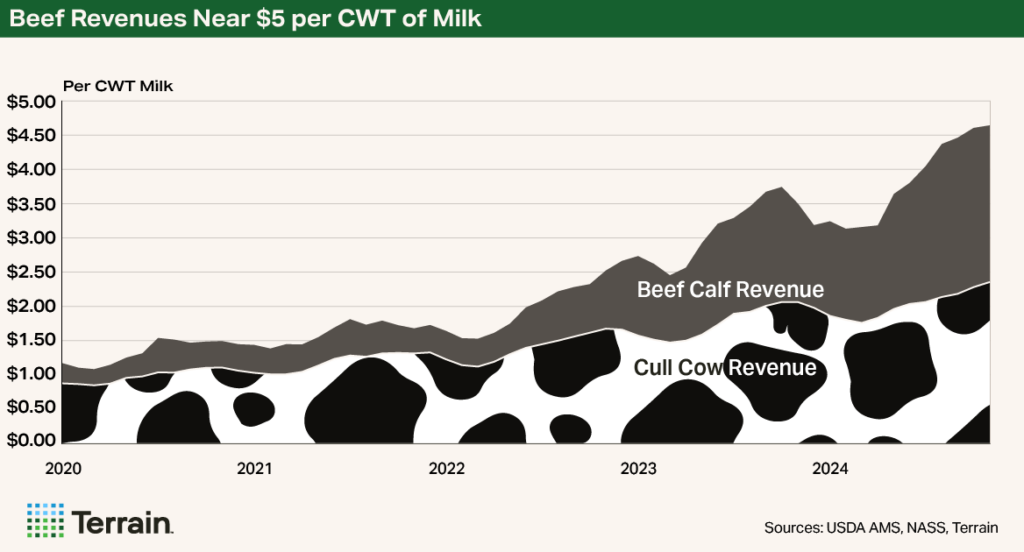

Beef revenues (both cull and beef cross calves) are adding the milk equivalent of around $4/cwt to $5/cwt to a dairy operation.

Outlook

My forecast for 2026 is for a first-quarter Class III milk price average of $15.50/cwt and a Class IV average of $14/cwt. Some relief should arrive in the second half, with Class III lifting to $18/cwt and Class IV to $16/cwt.

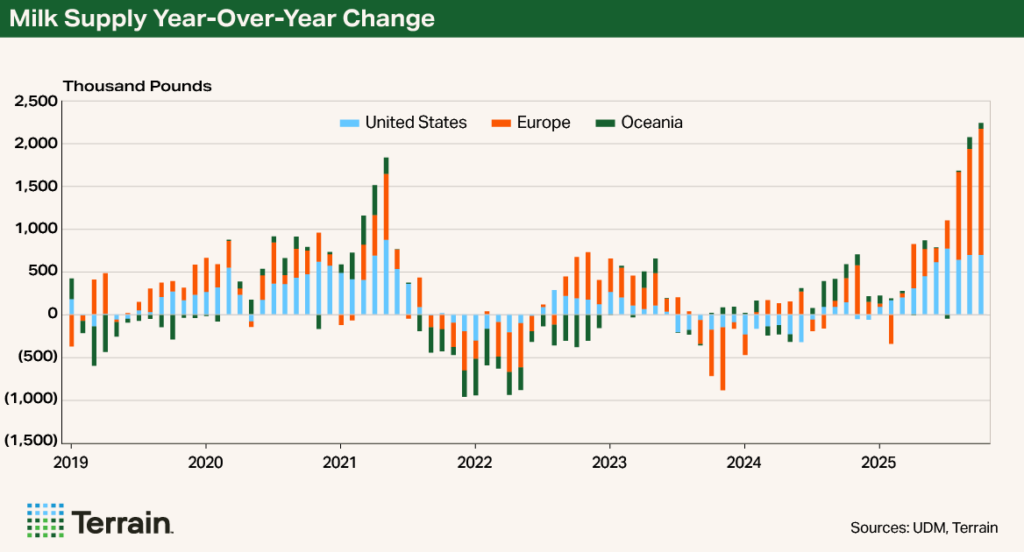

Dairy markets are finishing 2025 under the weight of heavy milk production growth, and surplus will be the theme through at least the beginning of 2026. U.S. milk production has risen over 3% year on year (YOY) each month since June. Production has also increased in Europe, up more than 5% YOY in October, and New Zealand, up 1.7% YOY in October. With global milk supply cresting, demand will struggle to stay afloat.

The unavoidable result will be low milk prices in the near term.

Beef revenues are adding the milk equivalent of around $4/cwt to $5/cwt to a dairy operation.

Beef Revenues Cloud Milk Price Signals

The good news is that strong beef-on-dairy revenues should soften the blow. Dairy producers are heading into this downturn with additional wherewithal following a couple of strong years on both the milk and beef side of the business. Additionally, many producers have at least some degree of coverage into the beginning of the year through insurance products like Dairy Revenue Protection.

Milk markets are sending signals to slow output and lower fat content, but strong beef revenues and low feed costs might mute those signals.

Beef revenues (both cull and beef cross calves) are adding the milk equivalent of around $4/cwt to $5/cwt to a dairy operation. This is having the effect of lowering the break-even milk price for an operation by the same amount and clouding the price signals to slow output that milk markets are trying to send. Meanwhile, milk prices are falling enough that they could break through the clouds and induce producers to curtail production.

Heading into 2026, I don’t expect markets to remain in a long-term slump.

Cheese and Butter Markets Weakening

Butter prices fell dramatically beginning midyear and have pressured Class IV prices. More recently, cheese prices have also fallen below their previously supported range, which will pull Class III lower.

Heading into 2026, I don’t expect markets to remain in a long-term slump, though pressure will certainly be felt for the next few months. There are paths that would achieve a midyear turnaround to normalize milk prices, but there are also risks of continued challenges.

If there is a silver lining to lower milk and dairy product prices, it’s that they tend to spur new export activity and new promotional activity domestically.

Exports were extremely strong in 2025 when the U.S. was at a discount to our global competitors. However, when global prices fell due to heavier output in Europe and New Zealand, the price advantage was washed away and exports slowed.

Cheese and butter are down slightly, but the boom in protein demand is clear.

Now, with butter and cheese prices falling, exports may pick back up, albeit at a lower price than before.

Protein Demand Is Booming

For domestic consumers, demand is mixed. Cheese and butter are down slightly, but the boom in protein demand is clear. Some of the protein demand can be attributed to the growth in GLP-1 drugs like Ozempic, but it also appears to be a broader cultural dietary shift. And dairy is ideally positioned to supply this protein through products like whey protein concentrates, isolates and ultra-filtered milk.

My forecast for 2026 is for a first-quarter Class III milk price average of $15.50/cwt and a Class IV average of $14/cwt.

This is good news for the industry, but it does not directly mean protein values will get a boost on milk checks. Whey does not factor into the protein value calculation in federal order formulas. It only impacts the “other solids” price on milk checks.

Still, I expect protein prices will be elevated compared with last year thanks to a quirk in the federal order protein pricing formula that lifts protein values when butter prices fall, if all else is held constant.

Price Forecast

My forecast for 2026 is for a first-quarter Class III milk price average of $15.50/cwt and a Class IV average of $14/cwt. Some relief should arrive in the second half, with Class III lifting to $18/cwt and Class IV to $16/cwt. I expect protein to average $2.70/lb. in 2026 and maintain a premium to butterfat, which I expect to average $1.90/lb.

Strong beef revenues don’t mean producers can hope to drift through the hard times.

Maintaining a Solid Strategy

Strong beef revenues don’t mean producers can hope to drift through the hard times.

Lower milk margins suggest it’s time to sharpen pencils, control costs (especially those focused on boosting fat output) and look for operational efficiencies. Although beef revenue might help ease the urgency, the strategy should remain the same.

Terrain™ content is an exclusive offering of AgCountry Farm Credit Services, Farm Credit Services of America, Frontier Farm Credit, and American AgCredit.

While the information contained in this site is accurate to the best of our knowledge, it is presented “as is,” with no guarantee of completeness, accuracy, or timeliness, and without warranty of any kind, express or implied. None of the contents on this site should be considered to constitute investment, legal, accounting, tax, or other advice of any kind. In no event will Terrain or its affiliated Associations and their respective agents and employees be liable to you or anyone else for any decision made or action taken in reliance on the information in this site.