Agricultural outlook for Q2 2025 from Terrain™, our service for agricultural insights. Author Bree Baatz is a Terrain grain and oilseed analyst. This article originally appeared on TerrainAg.com.

Farmers should stay patient and disciplined. Patient for old crop: I expect continued price rallies for old-crop corn driven by export sales strength and tight global supplies. Disciplined for new crop: If new-crop corn planted acres increase 4% in 2025 and corn has record yields above 180 bu./ac., we could see prices retest the sub-$4 levels post-new crop harvest. Be proactive and reward price rallies for new crop as we look ahead in the next three to six months, as the potential for increased supplies could weigh on prices.

The soybean-to-corn ratio for spring price favors corn at 2.24.

2025/26 Spring Price

Spring price discovery concluded with corn priced at $4.70/bu., nearly even with 2024’s price, and is already in the money with new-crop futures trading below $4.50/bu. Soybeans dropped from last year’s $11.55/bu. to $10.54/bu. The soybean-to-corn ratio for spring price favors corn at 2.24 and may prompt farmers to plant more corn acres instead of soybeans this spring, as currently projected by the USDA. What will farmers actually plant in the coming weeks? We will know more when farmers reveal their intentions in the March 31 Prospective Plantings report.

USDA Forecast

The USDA revised its estimates for the 2025/26 crop year during the Agricultural Outlook Forum at the end of February. It estimates spring planting at 94 million acres of corn, up 4% versus last year, and 84 million acres of soybeans, down 4%. Additionally, for the third consecutive year, the USDA predicts a national average corn yield that’s above 180 bu./ac. That’s a target that continues to be missed. A lot can change between now, planting and harvest that will determine final yields and production.

Until new-crop harvest, old-crop fundamentals should remain unchanged.

With favorable weather conditions, the USDA’s forecast could hold, which, if realized, would result in stocks-to-use around 12.9% and a 4% price decline for 2025/26. However, increasing input costs like fertilizer imports from Canada could prompt farmers to stick with soybeans, as they are a more cost-effective crop to produce. (Corn's cost of production is $871/ac., compared with $625/ac. for soybeans.) It is also important to note that 60% of corn acres are currently in drought, which would limit yields if this weather pattern persists well into the growing season.

Until new-crop harvest, old-crop fundamentals should remain unchanged. After the USDA revised its yield-per-acre number down in its January update for the 2024/25 crop, stocks-to-use is now projected at 10.2% for 2024/25, down from 14% in August (when corn futures traded under $4). Based on data from January 2014 to February 2025, stocks-to-use levels at or below 10% provide support to prices around $5/bu. Further increases in old-crop demand would tighten U.S. stocks-to-use and could be positive for prices to rally higher — depending on what the market expects for the size of the looming new crop.

Demand for U.S. old-crop corn remains strong.

Export Demand Will Drive Prices

Demand for U.S. old-crop corn remains strong. Feed use has stayed steady despite shocks from highly pathogenic avian influenza (HPAI), ethanol production has outpaced most weeks compared with last year, and exports have surged since harvest — currently at the fourth-highest level of commitments in over 30 years.

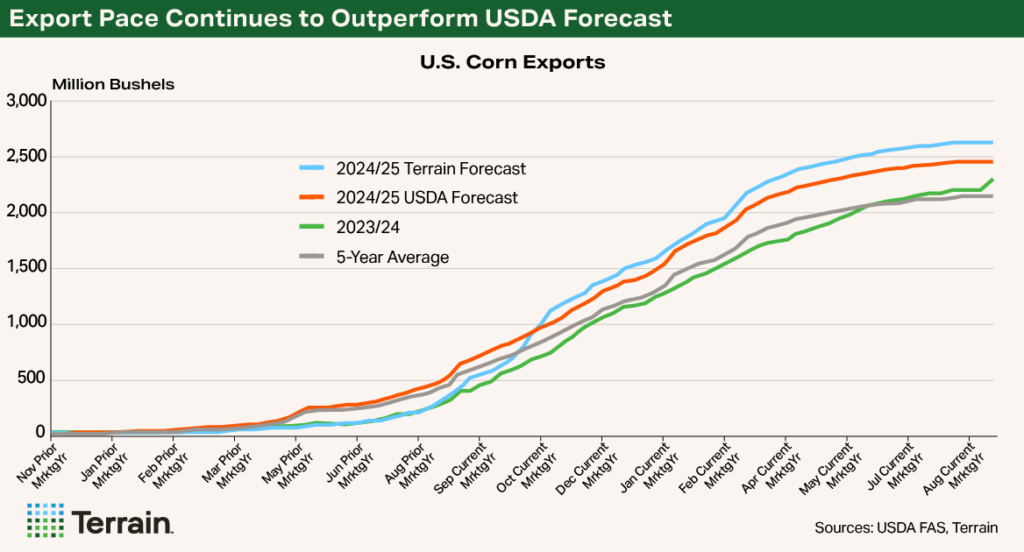

U.S. total current marketing year export sales are up 26% and up over 400 million bushels versus the same time last year, at nearly 2 billion bushels (crop year to date through February). Old-crop U.S. corn export sales have outpaced the USDA’s forecast by 4% through February, suggesting future upward revisions may be necessary if the current pace holds.

Any delays with Brazil’s harvest, which starts in June, could extend the U.S. export window.

As of March 7, the U.S. remains the most competitive global corn exporter, priced at $213 per metric ton. This advantage should last until Brazil’s Safrinha crop is harvested in early summer, as its overall domestic production is expected to increase by 7 million metric tons (MMTs) from last year to 126 MMT. However, delays in Brazil’s planting due to excessive moisture led the USDA to reduce its original corn production forecast, and as of the March update, exports were reduced by 2 MMT.

Any delays with Brazil’s harvest, which starts in June, could extend the U.S. export window. While Brazil does plan to expand into corn ethanol production, that will not start until the first half of 2026 and may only absorb 0.6 MMT from the export market.

At the same time, total global production for 2024/25 has decreased by 14 MMT (from 1,228 MMT in 2023/24 to 1,214 MMT in 2024/25), mainly because of the Russia-Ukraine conflict, while global demand has risen by 13 MMT. The U.S. is in an excellent position to capitalize on this trend, which may explain why the U.S. gained 14 new corn-buying countries since harvest compared with last year.

Mexico, the U.S.’s largest corn customer, has the potential to increase imports in 2025 due to the country’s drought-stricken domestic crops. Mexico’s restrictions on growing genetically modified white corn will only further increase the country’s need to import yellow No. 2 feed corn, as more yellow feed corn acres will pivot to white corn. The U.S. has a geographic and logistical advantage to supply.

Biofuels

The future of U.S. biofuels and their demand for corn and corn products remains uncertain due to potential policy changes. While the Synthetic Aviation Fuel (SAF) tax credit is in place through 2027, longer-term 45Z guidance is under review. And while the current Renewable Volume Obligation expires at the end of 2025 with no forward guidance, momentum is building for nationwide year-round sales of E15 (15% ethanol blend). Several Midwest states have already approved year-round E15 sales, which will start in April.

At the national level, each percentage increase in ethanol blend equates to 400 MBU of increased corn demand. Any domestic policy decision tied to biofuels will influence price direction for corn, soybeans, and competing crops for planting decisions.

Farmers should remain patient and disciplined in their marketing strategies for old-crop sales.

Conclusion

Given the recent price volatility, farmers should remain patient and disciplined in their marketing strategies for old-crop sales. While prices may currently face downward pressure, historically strong export demand and tight stocks suggest higher prices may return by summer. Any weather scare in the U.S. or Brazil could further support price increases.

However, if conditions are favorable and 94 million acres of corn are planted, absent an unexpected surge in demand from new export opportunities, the new-crop December 2025 contract could revisit the $3.80 low seen in August 2024.

Historically, spring prices for corn and soybeans are higher than the harvest price 70% of the time. I encourage farmers to proactively reward any price rallies above the spring price, up to their insurance-guaranteed bushel amount, as they move into spring and summer in advance of new-crop harvest.

Terrain™ content is an exclusive offering of Farm Credit Services of America, Frontier Farm Credit and American AgCredit.

While the information contained in this site is accurate to the best of our knowledge, it is presented “as is,” with no guarantee of completeness, accuracy, or timeliness, and without warranty of any kind, express or implied. None of the contents on this site should be considered to constitute investment, legal, accounting, tax, or other advice of any kind. In no event will Terrain or its affiliated Associations and their respective agents and employees be liable to you or anyone else for any decision made or action taken in reliance on the information in this site.