Article published on TerrainAg.com. Author Matt Clark is Terrain’s senior rural economy analyst. Author Bree Baatz is a Terrain grain and oilseed analyst. Author Chris Bitter, Ph.D. is Terrain’s senior wine and grape analyst. Author Ben Laine is Terrain’s senior dairy analyst. Author Dave Weaber is Terrain’s senior animal protein analyst. Author Matt Woolf, Ph.D. is Terrain’s specialty crop analyst.

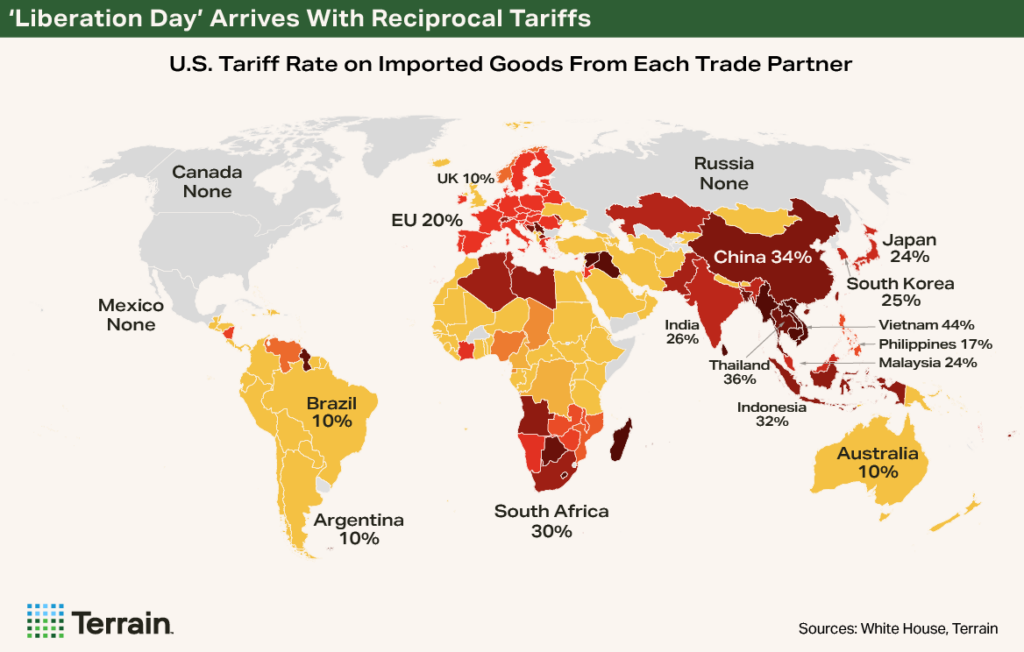

President Trump, on April 3, announced a range of reciprocal tariffs with the overarching, stated goal of rebalancing global trade relationships. The U.S. will apply a minimum tariff rate of 10% to nearly all imports effective April 5, 2025. Additionally, many countries will be levied a higher tariff rate, 11%-50%, effective April 9 (list of countries here). A handful of countries, chiefly Canada and Mexico, are exempt from all tariffs.

Once effective, the tariffs will impact nearly 68% of the global economy and 92% of the global population wishing to export to the U.S.

Once effective, the tariffs will impact nearly 68% of the global economy and 92% of the global population wishing to export to the U.S. Countries such as China have announced counter-tariffs, while others such as the EU have announced preparations for countermeasures. Still others, including Vietnam and Costa Rica, have signaled a willingness to engage on tariff reducing measures.

This analysis was conducted before the additional Chinese tariffs started April 9, 2025.

The difference in response to the initial announcement highlights the folly of jumping to a conclusion on the net impact, good or bad, to the agricultural industry. This article provides a rundown of the facts as they exist. This analysis was conducted before the additional Chinese tariffs started April 9, 2025.

Impact to Agricultural Imports

Initially, the impact will be felt mostly on imports. For U.S. agriculture, this applies to inputs of farm products and food products, both competing and complementary.

Starting with farm inputs, the current administration released a list of exempt products that includes minerals, fertilizers, chemicals and veterinary medicines – keep in mind, too, that supplies from Canada and Mexico will also be exempt.

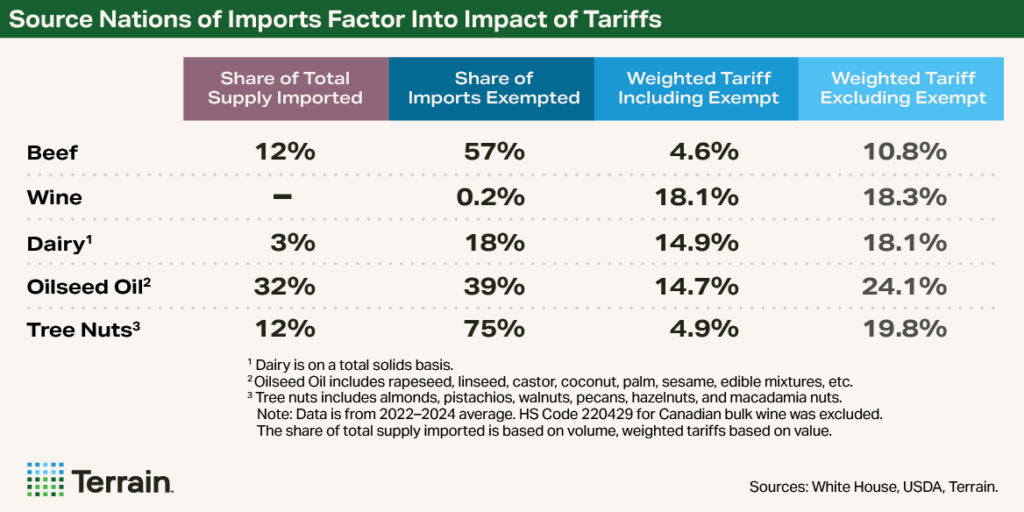

Second, agricultural goods coming into the U.S. also will be tariffed; however, Mexico, Canada and other exempt nations have accounted for 42% of total agricultural imports from 2022 to 2024. The remaining 58% of agricultural imports will face a trade-weighted tariff of 18.6%, but the trade-weighted tariff falls significantly to 10.7% when factoring in exempt countries.

Accounting for about 52% of all agricultural imports, the largest agricultural imports to the U.S. are:

- Fresh fruits and vegetables

- Oilseed oil

- Distilled spirits

- Beef

- Coffee

- Baking wares

- Beer

- Soup

- Wine

Importantly, Mexico and Canada supplied just under half of these products to the U.S. As such, the current tariff policy may push importers to rely more heavily on Canada and Mexico.

The Federal Reserve Bank of Kansas City provided additional information on the impact to the Consumer Price Index (CPI) food-at-home basket, which can be found here in Chart 3.

How the Tariffs on Foreign Imports May Play Out Differently for Various Agricultural Sectors

Dairy Has Limited Impact from Import Changes

Most dairy products imported into the U.S. are specialty European cheeses and Irish butter. This makes substitution a challenge. But, since these products tend to be higher-priced, premium products, consumers may be less price sensitive.

Some Adjustment May Come in Beef Trimmings Markets

Duties levied on beef imports are focused on Australia, New Zealand, Brazil, Argentina and the EU-27 countries. Most imports from Oceania and South and Central American countries are lean trimmings destined for ground beef production. Only beef imports from Canada and Mexico remain at 0% duty, while $2.9 billion worth of Australian imports are now levied a 10% duty and Brazilian beef shipments face a 36.4% tariff.

Domestic 50% lean trimmings prices are likely to see downward pressure if the new tariff rates substantially reduce import volumes because the 50% trimmings are used to blend with the 90% trimmings imported from Australia to make the ideal blend for patty makers. If the industry shifts to using domestic, fattier 80% product as well as more ground chucks and rounds, fewer pounds of 50% lean trimmings would be required to make the same ideal blend. It’s hard for the middle meat (rib and loin) demand and resulting rise in end meat (chuck and round) prices to offset the drag that the extra 50% lean trimmings would have on the beef market.

U.S. beef can probably withstand retaliatory tariffs levied by Korea and Japan, our two largest export markets by value, as well as China. Korea already has a 2.7% duty on imported U.S. beef, while Japan assesses a 21.6% duty. China had a 12% duty on U.S. beef that was left over from the Phase One negotiations and has announced an additional 10% duty in retaliation. Even with the previously existing tariffs, all three of these Asian countries have been significant buyers of high-quality, high-value U.S. beef.

Biofuel Production May Turn to Soybean Oil - Finally

Oilseed oils have some substitutability in food manufacturing as well as feedstock usage for bio-fuel production. Waste oils, fats and greases like used cooking oil, corn oil and tallow can be alternative feedstocks for bio-fuel production. Various federal and state tax credits have incentivized certain feedstocks based on carbon intensity (CI) scores. Corn oil and used cooking oil both have a much lower (better) CI compared to oilseed oils like rapeseed and soybean oil. If imports of rapeseed oil and used cooking oil become more expensive, biofuel production could move to more domestically produced soybean oil.

Biggest Impact for Tree Nuts Comes from Counter-Tariffs

Overall, only about 12% of total nut supply in the U.S. comes from imports. For some nuts like macadamia nuts and hazelnuts, imports relative to supply is relatively high. For others like almonds, walnuts, and pistachios, it is nearly zero. While import tariffs will hardly affect the U.S. nut consumer, domestic nut producers could be greatly affected by counter-tariffs on U.S. exports given the proportion of production exported.

Wine Industry Eyes Changes Ahead

By value, the U.S. imports approximately five times as much wine as it exports, and imported wines (including imported bulk blended with American wine) represent one-third of U.S. wine sales by volume.

The potential ramifications for domestic wine producers and grape growers are complex. For one, import market share varies widely across product types and price points, as does the degree of substitutability with domestic wines. On the cost side, many large domestic wineries import and bottle foreign bulk wine, and many inputs, including bottles and capsules, are sourced from foreign producers. Finally, tariffs could weaken U.S. wine distributors and sellers, disrupting the path to market for domestic wineries.

Impacts to Agricultural Exports

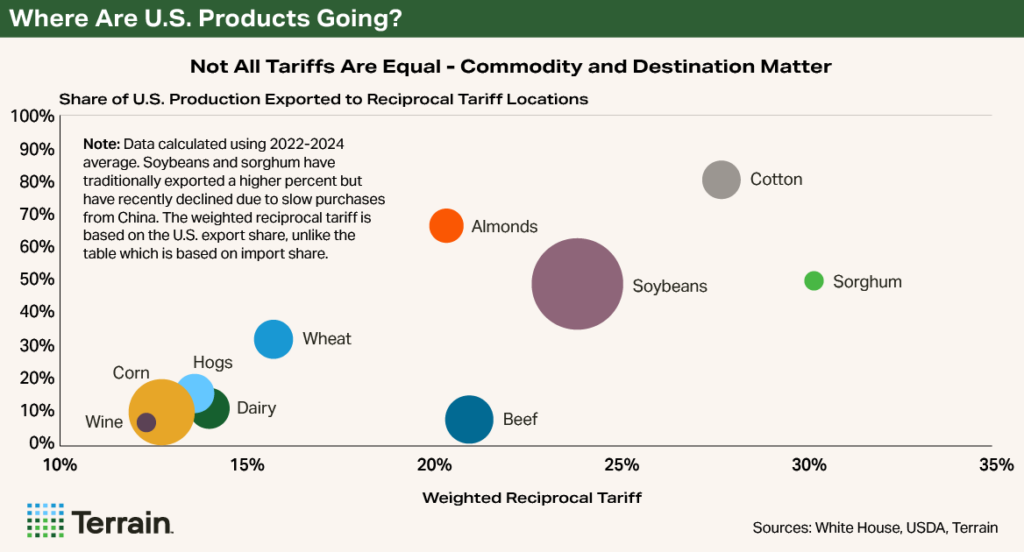

To date, only a handful of countries have announced counter-tariffs that would impact U.S. agriculture exports. The impact of counter-tariffs would vary greatly as commodities have unique export trade decks.

Commodities such as beef, wine, dairy and corn are primarily consumed in the U.S. or by countries exempted from reciprocal tariffs, whereas commodities such as cotton, almonds, sorghum and soybeans are much more dependent on exports to countries that were assessed a reciprocal tariff. Interestingly, commodities that rely less on exports also tend to have a smaller weighted reciprocal tariff applied to their trade partners, with beef as the noted exception.

There are both risks and opportunities in this tariff environment. Commodities with a large export exposure, or a high-weighted tariff, could suffer in an escalating tariff environment or benefit from an improved trade relationship. Contrariwise, commodities such as beef and wine that export limited quantities of product and import large amounts of product could see varying impacts to the positive or negative ledger.

Considerations for the Producer

This is a period when the number of questions outruns the number (and quality) of answers. In these times, it is often advisable to bucket decisions into those already made, or those that will happen regardless, and those that are truly “variable.”

Decisions that are already made or will happen regardless of new tariff policy are “sunk costs” in a sense. For example, equipment and input decisions made over the last six months are what they are and should already be factored into breakeven costs and financial plans.

However, the small amount of truly “variable” decisions at this point should be weighed carefully by considering potential risks and opportunities.

Additionally, it is important to remember that doing nothing is in fact doing something, especially in commodity markets. So, while it is very unsatisfying to watch-and-wait for opportunities, often the active manager and marketer can thrive under these circumstances.

Terrain™ content is an exclusive offering of Farm Credit Services of America, Frontier Farm Credit and American AgCredit.

While the information contained in this site is accurate to the best of our knowledge, it is presented “as is,” with no guarantee of completeness, accuracy, or timeliness, and without warranty of any kind, express or implied. None of the contents on this site should be considered to constitute investment, legal, accounting, tax, or other advice of any kind. In no event will Terrain or its affiliated Associations and their respective agents and employees be liable to you or anyone else for any decision made or action taken in reliance on the information in this site.